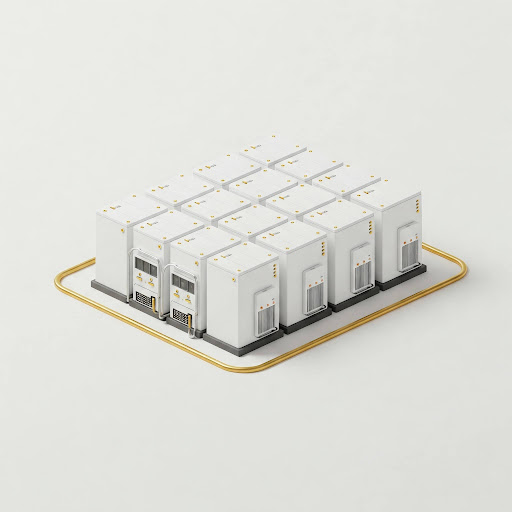

StackEase optimizes profits for grid-connected batteries

25MW

Real assets currently being optimized on cross-markets in France

309k€/MW

Annulalized profit for a 10MW/20MWh battery from June 2024 to June 2025

99%

Comparison of StackEase profit vs perfect foresight (PF on FCR capacity, aFRR capacity and day-ahead prices)

100%

Transparency, gain full insight and monitor your asset operations via a live dashboard

We help you to develop

and to operate your storage asset

Consulting

For battery developers and asset owners, we deliver profitability forecasts and asset sizing recommendations to guide investment decisions for standalone or co-located storage projects.

Bidding recommendations

Our services for market participants, such as aggregators and battery asset owners, include 24/7 mutli-market trading recommendations, real-time monitoring, and strategic bidding policy re-evaluation.

Agregation

Partnering with trusted aggregators, we offer turnkey battery asset management that maximizes owner profitability through pooled aFRR market participation, driven by continuous, 24/7 multi-market optimization.

StackEase delivers trusted battery profit optimization, using field-proven advanced algorithmic trading

They support us

We proudly acknowledge our early partners, featured here, and thank them for placing their trust in us from the start.

INRIA

Techstars

BPI

Réseau Entpreprendre

Wilco